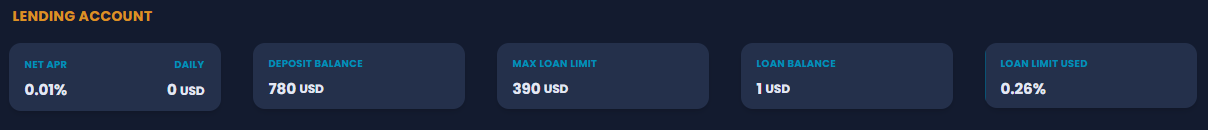

Lending Account

Lending account section of the Lending page shows the general overview of the users current positions.

All of the fields in this section and their meaning are described below:

NET APR

Annual percentage rate (APR) refers to the yearly interest generated by a sum that's charged to borrowers or paid to investors. Net APR in this case is the total APR of all of the assets for the user. It can be positive or negative. Net APR is calculated with the following formula:

SUM[pool](user_deposit_balance * deposit APR - user_borrow_balance * borrow APR) / SUM[pool]user_deposit_balance

DAILY

Represents the daily gains of the user in USD. It is calculated using the following formula:

SUM[pool](user_deposit_balance * USD value of asset) * Net APR / 100 / 365

DEPOSIT BALANCE

Sum total of the users deposits represented in USD.

MAX LOAN LIMIT

Sum total of loans that the user can take based on collateral and loan-to-value ratio represented in USD. It is calculated using the following formula:

SUM[pool] (user_deposit_balance * ltv_ratio * USD value of asset)

LOAN BALANCE

Sum total of the users loans represented in USD.

LOAN LIMIT USED

Percentage of max loan limit that the user borrowed represented in USD. It is calculated using the following formula:

SUM[pool](user_borrow_balance) / SUM[pool](user_deposit_balance * ltv_ratio) * 100